A Comprehensive Review of the NewCredit Loan App

As you search for personal loan options to meet your financial needs, you may come across ads for smartphone apps promising quick cash. One such app, Covering a loan range of N5,000 to N500,000, the platform provides borrowers with adaptable and competitive loan options tailored to their specific financial requirements.

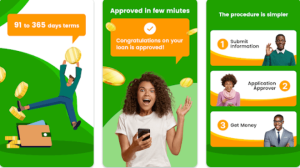

With tantalizing promotions like no credit checks required, it’s tempting to download the app right away. But before entering your personal information, it’s wise to thoroughly vet NewCredit’s features, rates, fees, eligibility rules and legal standing.

This review summarizes other borrowers’ experiences with NewCredit to help you determine if its loans make sense for your situation. We’ll objectively assess everything from its multi-factor approval process and same-day funding promises to its late fees policy and actual customer service track record. Read on for an in-depth look at the pros, cons and legitimacy of using NewCredit for your next loan.

An Overview of the NewCredit Loan App

To get started, download the NewCredit app on your iOS or Android device. You will need to provide some personal information to verify your identity, including your name, address, Social Security number, and income details. NewCredit will perform a soft credit check, which will not affect your credit score, to determine your eligibility and loan terms.

If approved, NewCredit will provide you with your loan offer details, including the loan amount, APR, fees, and repayment schedule. Carefully review all terms and conditions before electronically signing your loan agreement. Funds are typically deposited in your bank account within 1 to 2 business days.

NewCredit allows you to choose between monthly installment payments for 12 to 60 months. Payments are automatically deducted from your bank account each month. You can pay off your loan early with no prepayment penalties. NewCredit reports to credit bureaus, so on-time payments can help build your credit.

The NewCredit app allows you to view details for all your loans in one place. You can see your balance, interest paid to date, next payment due date, and transaction history. You can also make one-time payments or set up autopay directly in the app. Customer service is available via chat in the app, phone, or email if you have any questions about your account.

In summary, the NewCredit personal loan app offers a straightforward way to apply for and manage installment loans from your mobile device. Competitive rates and flexible terms, combined with the convenience of the mobile app, make NewCredit an attractive option for those looking to borrow money. However, be sure to compare offers from multiple lenders to get the best deal based on your needs and credit profile.

Key Features and Benefits of NewCredit Loans

NewCredit loans offer several useful features for borrowers looking to consolidate high-interest debt or finance large purchases.

Fast, Easy Application Process

Applying for a NewCredit loan can be completed entirely online in a matter of minutes. Borrowers need only provide basic personal information like name, address, Social Security number, and bank account details. There are no application fees and loan decisions are provided instantly upon submission.

Flexible Loan Terms

NewCredit offers loans with terms ranging from 24 to 60 months. Borrowers can choose a repayment schedule that suits their needs and budget. Interest rates also vary depending on factors like the borrower’s credit score, debt-to-income ratio, and loan term selected. Fixed interest rates mean predictable monthly payments that never change over the life of the loan.

Online Account Management

Once approved and funded, NewCredit borrowers gain access to an online account portal to view details like the loan amount, interest rate, fees, and a repayment schedule. Borrowers can also pay their bill online each month through the portal via bank transfer, debit card, or wire payment. Payments are reported to credit bureaus to help build credit.

Overall, NewCredit loans provide a quick and convenient borrowing option for those in need of funds for a variety of personal uses. The online application, flexible terms, large maximum amounts, and account management tools make NewCredit an attractive choice for many borrowers. However, as with any loan, borrowers should compare all terms and fees carefully before accepting an offer.

Is NewCredit Legit and Safe to Use? The Pros and Cons

Pros

Overall, NewCredit appears to be a legitimate lending platform. Some of the benefits of using their service include:

- Simple application process. Applying for a loan through NewCredit only takes a few minutes. You provide some basic personal information and the loan amount you need. There are no complicated forms to fill out.

- Fast funding. If approved, NewCredit deposits loan funds into your bank account as soon as the next business day. This can be helpful if you have an urgent need for cash.

- Flexible terms. NewCredit offers loans with terms ranging from 3 months up to 5 years. You can choose a repayment plan that fits your budget and needs.

- No prepayment penalties. You can repay your NewCredit loan early without incurring any fees. This can save you money on interest charges.

Cons

However, there are some potential downsides to be aware of:

- High interest rates. Interest rates on NewCredit loans may be significantly higher than a personal loan from a bank or credit union. Rates can range from 9.95% up to 35.99% APR.

- Limited loan amounts. NewCredit caps loan amounts at $5,000 for first-time borrowers. The maximum loan amount is $35,000, but you have to build up your borrowing history to qualify for larger loans.

- No grace period. Repayments on NewCredit loans begin immediately after the loan is issued. There is no grace or deferment period. Late or missed payments can hurt your credit and result in additional fees.

- Limited payment methods. You can only repay NewCredit loans through automatic bank account deductions. They do not accept credit card, debit card, cash or check payments.

In summary, NewCredit can be a convenient option if you need fast access to cash and are comfortable with higher interest rates. However, you need to make sure the repayment terms fit your budget to avoid potential issues. For lower rates and more flexible options, you may want to check with traditional banks or credit unions first.

Xcredit’s Loan App: Understanding the Application Process and Evaluating Legitimacy

Conclusion

As you have seen, the NewCredit loan app provides a unique lending solution with competitive rates and flexible terms. While any loan product merits careful consideration of risks and rewards, NewCredit strives for transparency regarding all fees and obligations.

Evaluate your specific borrowing needs to determine if their offerings match your situation. Weigh the value of convenience and speed against alternatives. Most importantly, enter any financial agreement with full awareness to make the best choice for your personal finances. Consider all we have covered as you decide whether NewCredit aligns with your goals.